You’ll find Montana ghost towns ranging from $480,000 fixer-uppers to $2.6 million turnkey operations with established revenue streams. Pray, located 30 miles from Yellowstone’s north entrance, offers four rentals, a general store, and post office generating immediate cash flow. Gunslinger Gulch near Anaconda provides 52 acres with film location income and B&B potential, while Frontier Town delivers a 75-year operational track record at $1.7 million. Each property combines historic preservation with tourism-driven investment opportunities worth exploring further.

Key Takeaways

- Gunslinger Gulch, a 52-acre property with 19 historic buildings, generates income through film locations, bed and breakfast, and paranormal experiences.

- Pray, listed at $2.6 million, includes four short-term rentals, a general store, post office, and RV spaces near Yellowstone’s north entrance.

- Frontier Town, operational since 1948, is listed at $1.7 million and features a 75-year track record as a tourist attraction.

- Pray’s value appreciation from $480,000 in 2018 to $2.6 million demonstrates strong investment potential in Yellowstone-adjacent properties.

- Revenue opportunities include film production fees, event tourism, short-term rentals, and proximity to Yellowstone National Park attractions.

Gunslinger Gulch: A Historic Film Location Near Anaconda

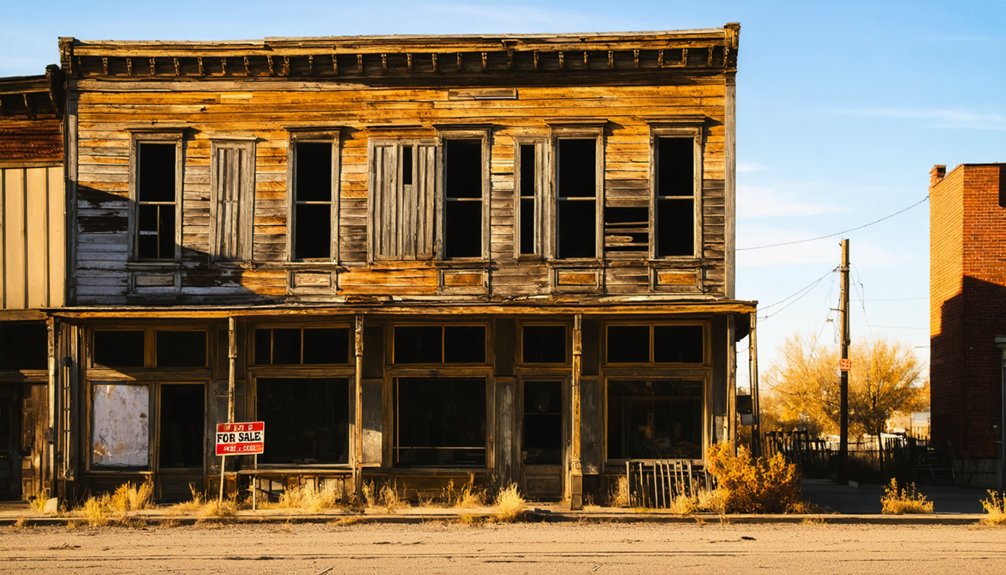

Nestled on 52 acres northwest of Anaconda at 1600 Cable Road, Gunslinger Gulch represents a rare opportunity to own a turnkey Montana attraction with proven revenue streams.

This 19-building complex features authentic structures from 1854-1856, salvaged from demolition in the 1990s. You’ll control a diverse income portfolio: historic accommodations operating as a bed and breakfast, film location fees from productions like ‘1923’ and ‘Dead 7’, and specialized paranormal experiences that’ve driven bookings since Travel Channel’s ‘Ghost Town Terror’ series. The property has also been featured in video games including ‘Far Cry 5.’

The property generates revenue through vacation rentals, murder mystery events, music festivals, and group gatherings. With new 2026 all-inclusive packages commanding $666 nightly and plans for a cowboy shooting range, you’re acquiring established infrastructure ready for immediate operation and expansion. Notable structures include a boarding house and brothel situated above the saloon, adding authentic historic character to guest experiences.

Pray: Gateway Community to Yellowstone’s Northern Paradise

You’ll find Pray positioned in Paradise Valley near Yellowstone’s north entrance, where it served Park County as a primary services hub since 1907.

The property sold for $480,000 in 2018 and now lists at $2.6 million after renovations including a septic system and restored general store.

The town was named after Congressman Nelson Pray, who lent his name to the settlement during its establishment.

This gateway location attracts international buyer interest for its community revival potential, though it’s awaiting an owner committed to restoring its highest-use service role.

Like nearby Copper City, which transformed from a failed mining settlement into a recreational destination with its 22-mile mountain bike trail completed in 2019, Montana’s ghost towns continue finding new purposes beyond their original industries.

Paradise Valley Setting

The Yellowstone River carves through 53 miles of Paradise Valley, creating one of Montana’s most valuable real estate corridors between Livingston and Gardiner.

You’ll find properties flanked by the Absaroka Range to the east and Gallatin Range to the west, with direct access via US Highway 89.

The valley’s scenic beauty commands premium pricing—ranch lands here benefit from world-class fly fishing rights, proximity to Yellowstone National Park’s north entrance, and year-round outdoor activities including skiing at nearby resorts.

Natural hot springs at Chico and Hunter’s add resort development potential.

You’re investing in America’s longest undammed river system, winter elk habitat, and a tourism gateway that’s attracted visitors since 1872.

Land prices reflect the valley’s irreplaceable positioning between two mountain ranges and adjacent to protected wilderness.

The region’s complex geological history includes basement rocks, Paleozoic formations, and evidence of both compressive and extensional tectonics that shaped the valley over millions of years.

Interstate 90 provides critical connectivity linking Paradise Valley to Bozeman through Bozeman Pass, enhancing accessibility for residents and commercial operations.

Investment Opportunity Details

Pray’s $2.6 million asking price reflects a dramatic appreciation trajectory since its 2018 sale at $480,000, positioning this 5-acre package as a turnkey revenue generator in Montana’s premier tourist corridor.

You’ll acquire four contemporary short-term rentals, an operational general store, functioning post office, long-term rental residence, and RV space—all strategically positioned 30 miles from Yellowstone’s north entrance.

Current real estate trends show Pray’s median listing price at $1,200,000, validating this property’s premium positioning.

Tourism impact drives immediate cash flow potential through multiple revenue streams serving park visitors and outdoor enthusiasts.

The package delivers diversified income without typical startup barriers, letting you capitalize on Paradise Valley’s surging demand while maintaining operational independence in Montana’s gateway market.

The broader regional market encompasses popular zip codes including 59047, 59027, and 59065, reflecting strong real estate activity throughout the surrounding area.

Established in 1907, the town carries the name of Congressman Charles Nelson Pray and represents an extraordinarily rare opportunity to own an entire Montana settlement with deep regional heritage.

Frontier Town: Montana’s Classic Wild West Tourist Attraction

You’ll find Frontier Town offers a rare opportunity to acquire an operational Wild West attraction that’s welcomed visitors since 1948.

This established tourist destination carries a $1.7 million asking price, positioning it as a competitively valued entry point in Montana’s ghost town market.

The property’s 75-year operational track record demonstrates proven commercial viability in the state’s tourism economy.

State-owned ghost towns like Virginia City face operational challenges as rising lease terms create tensions between heritage property managers and attraction owners.

Meanwhile, the nearby town of Pray in Paradise Valley presents another investment opportunity at $2.6 million, complete with a functioning post office and century-old general store.

Historic Attraction Since 1948

Perched atop the Continental Divide west of Helena, Frontier Town emerged in 1948 as John R. Quigley’s handcrafted vision of Western independence.

You’ll find a monument to self-reliance here—Quigley constructed this replica Old West town almost singlehandedly using native logs and stone, creating Montana’s premier post-WWII roadside attraction.

The property’s 50-foot split log bar, carved from a single Douglas Fir, stands as a testament to American craftsmanship and entrepreneurial spirit.

During its heyday, 2,000 daily visitors experienced authentic frontier living through the Main Street, chapel, and dining room overlooking Helena Valley.

After decades closed to the public, the 2024 purchase by the Hays family signals a Frontier Revival opportunity.

This Historic Preservation project represents more than nostalgia—it’s reclaiming a piece of Montana’s self-made heritage.

1.7 Million Asking Price

At $2.6 million, Pray’s asking price reflects Montana’s escalating small-town market where functional communities command premium valuations over abandoned ghost towns.

You’ll find this represents significant appreciation from the 2018 purchase price of $480,000, demonstrating strong market valuation trends for operational properties near Yellowstone’s gateway.

The 2021 sale at $2.25 million included infrastructure upgrades like septic systems and renovated structures, adding tangible value beyond raw land.

Compare this to Montana’s $1.7 million ghost town offering—Pray’s community appeal stems from its active post office, working general store, and maintained zip code since 1907.

You’re not buying abandonment; you’re acquiring a functioning municipality with revenue-generating potential.

The property’s 45-minute proximity to Yellowstone positions you for tourism-based returns while maintaining authentic small-town autonomy.

Virginia City and Nevada City: State-Owned Heritage Sites Facing Change

When Montana’s legislature created the Montana Heritage Commission in 1997 to manage the historic Bovey family properties, the arrangement promised to balance preservation with economic importance.

You’ll find these state-owned towns now facing unprecedented turbulence as the MHC terminates contracts with over half a dozen businesses. The economic impacts hit hard—local businesses contribute $60,000 annually in resort taxes alone.

The MHC’s mass contract terminations create economic upheaval for state-owned historic towns, jeopardizing $60,000 in annual resort tax revenue.

New proposed contracts demanding 15% of gross sales threaten your freedom to operate profitably in these historic locations.

While heritage preservation remains critical for properties like the Grace Methodist Episcopal Church and Montana Post Building, you’re watching Commerce Department reviews uncover irregularities that question the commission’s management.

State statute requires protecting these treasures while encouraging economic stability—a balance currently under siege.

Garnet Ghost Town: Missoula’s Mining-Era Treasure

While state-managed heritage sites grapple with administrative challenges, Garnet Ghost Town thirty miles east of Missoula offers you a different preservation model—one that’s maintained Montana’s most intact mining settlement without the contractual disputes plaguing Virginia City.

Garnet history reveals a classic boom-and-bust cycle: founded in 1895, the town peaked at nearly 1,000 residents by 1900 before fires and gold depletion triggered decades of decline.

Yet this mining heritage site demonstrates remarkable preservation value—thirty buildings still stand at 6,000 feet elevation, maintained through community stewardship rather than state bureaucracy.

The Garnet Preservation Association operates with focused efficiency, protecting structures that generated between $950,000 and $1,400,000 in gold production.

For investors seeking authenticity without governmental red tape, Garnet represents mining-era Montana preserved through local autonomy rather than political intervention.

Reeder’s Alley: Helena’s Historic Quarter in Transition

Unlike Garnet’s isolated mountain setting, Reeder’s Alley occupies premium real estate at downtown Helena’s southwestern edge—where Louis Reeder’s 1872-1884 brick row houses transformed miner housing into Montana’s most commercially viable historic quarter.

You’ll find Historical Significance here that translates directly into revenue potential. What started as thirty-two one-room apartments for gold rush miners now operates as an open-air exhibit featuring unique shops and preserved 1870s architecture.

The Montana Heritage Commission manages key structures, while private ownership opportunities remain.

Reeder’s Alley represents adaptive reuse done right—gold dust rent payments evolved into modern commercial leases. Located at Mount Helena’s base, this quarter demonstrates how Helena’s oldest residential area survived red-light district changes, Chinese immigrant occupancy, and economic shifts to become a preservation success story that generates income.

Investment Opportunities and Preservation Challenges

Montana’s ghost town market presents acquisitions ranging from $1.7 million themed attractions to individual properties like Garryowen and Pray—but current ownership battles reveal the financial pressures threatening these investments.

investment risks extend beyond purchase price. State-owned sites near Virginia City face escalating lease disputes, while Gunslinger Gulch’s contract-for-deed arrangement confronts potential developer conversion to luxury housing.

You’ll encounter operational challenges including vendor standoffs, embezzlement cases, and unpredictable rent hikes that jeopardize tourism revenue streams.

Successful preservation strategies require balancing historic integrity with commercial viability. Properties functioning as filming locations, event spaces, and bed-and-breakfasts demonstrate revenue diversification, yet Montana’s cash crunch threatens sustainability.

Historic ghost towns must generate revenue through multiple channels while maintaining authenticity to survive Montana’s ongoing financial constraints.

Consider 99-year lease structures for long-term control and evaluate whether development pressures from population growth align with your preservation objectives before committing capital.

From Movie Sets to Murder Mysteries: Event-Driven Revenue Models

Historic ghost towns generate substantial film production income, with Livingston capturing more shoots than any Montana location—including A River Runs Through It (1992) and Yellowstone (2018-2024).

You’ll find ghost town tourism revenues extend beyond traditional admission fees when you leverage filming locations as event-driven assets.

Butte’s 70 IMDb credits and Nevada City’s preserved 1800s structures demonstrate proven market demand.

Consider these revenue streams:

- Film production fees from features like Murder at Yellowstone City (2022) and The Ghost Town Terror series

- Mystery event tourism capitalizing on productions like Ghosts of Gold Creek (2024)

- Television series licensing following Yellowstone’s success in Garnet and other Western Montana ghost towns

Bannack, Virginia City, and Anaconda’s 24+ IMDb titles prove filming locations generate repeatable income while preserving authentic Western architecture that attracts independent producers.

The Future of Montana’s Ghost Town Marketplace

While filming revenues provide immediate returns, Montana’s ghost town marketplace faces a critical inflection point as financial pressures collide with development ambitions.

You’re watching state-owned sites raise vendor leases amid cash crunches, while properties like Gunslinger Gulch teeter between preservation and luxury housing development.

The market challenges are stark: high interest rates stalling $600k sales, embezzlement cases draining operator funds, and growing populations pressuring traditional tourism models.

Future developments will likely bifurcate the marketplace.

You’ll see affordable rustic cabins in Garnet ($90,000-$100,000) attracting DIY preservationists, while turnkey operations like Frontier Town command premium prices with modern amenities.

State proposals for 99-year leases signal commitment to heritage tourism, yet Anaconda’s developer pressures reveal the tension.

Your investment decision hinges on whether Montana prioritizes its frontier character over residential sprawl.

Frequently Asked Questions

What Permits Are Required to Operate a Ghost Town as a Commercial Business?

You’ll need local business licenses from county offices, Special Recreation Permits for BLM land use, and operational permits for specific activities like food service or guided tours. Requirements vary by location and planned commercial operations.

Can Ghost Town Properties Qualify for Historic Preservation Tax Credits?

Yes, if you’ve got income-producing buildings with historic significance. Montana’s tax incentives deliver 25% state credits plus 20% federal credits—turning your ghost town restoration into a lucrative investment opportunity while preserving authentic Western heritage.

Are Original Ghost Town Buildings Structurally Safe for Public Access?

Most original buildings aren’t structurally safe without thorough building inspections and safety regulations compliance. You’ll need professional assessments before allowing public access, as Montana’s ghost town structures typically lack modern safety systems and show significant deterioration.

What Zoning Restrictions Apply When Purchasing a Ghost Town Property?

Ironically, you’ll gain freedom through restrictions: zoning classifications vary by county, dictating property usage for your ghost town investment. You’ll need Planning Board approval, minimum lot requirements, and compliance with Montana’s growth policies before developing your historic opportunity.

Do Ghost Towns Include Water Rights and Mineral Rights in Sales?

Water rights and mineral rights aren’t automatically included in Montana ghost town sales—you’ll need to verify what’s conveyed. These valuable assets can be severed from land, so you should negotiate explicitly to protect your investment freedom.

References

- https://nbcmontana.com/news/local/anaconda-area-ghost-town-owner-seeking-investment-to-remain-open

- https://www.djc.com/news/bu/12173611.html

- https://cowboystatedaily.com/2025/04/19/a-whole-town-near-yellowstone-is-for-sale-for-less-than-3-million/

- https://bluemountainbb.com/blog/ghost-towns-montana/

- https://billingsmix.com/for-sale-old-wild-west-theme-town-attraction-in-montana/

- https://www.realtor.com/news/trends/ghost-towns-properties/

- https://www.youtube.com/watch?v=_G3DmyRNNWk

- https://963theblaze.com/montana-ghost-town-saved-last-minute-rescue-halts-foreclosure/

- https://www.kxlf.com/news/local-news/chills-and-thrills-anaconda-ghost-town-featured-on-new-travel-channel-show

- https://gunslingergulch.com