You’ll find America’s former boomtowns experiencing dramatic population losses, with California (-239,000), New York (-102,000), and Illinois (-80,000) leading the exodus. High housing costs and limited jobs drive residents—especially young adults—toward affordable southern states. Meanwhile, once-hot Sun Belt markets face corrections, with Austin home prices dropping 23% from their peak. Rental markets have softened 6%, while northeastern states show surprising stability, leveraging established infrastructure amid this geographic economic realignment.

Key Takeaways

- Major population exodus from California (-239,000), New York (-102,000), and Illinois (-80,000) shows dramatic decline in former urban centers.

- Sun Belt housing markets experienced sharp corrections, with Austin prices dropping 23% from 2022 peak and Tampa declining 5.4% year-over-year.

- Institutional investors are abandoning boom regions, liquidating holdings and causing vacancy rates to surge past 8%.

- Manufacturing job losses (3.5 million from 2000-2009) devastated specialized communities, leading to persistent unemployment above pre-boom levels.

- High housing costs coupled with limited job growth drive young adults away from once-thriving cities toward more affordable regions.

Population Exodus: Once-Booming Cities Now Losing Residents

As the demographic landscape of the United States continues to shift, several former boomtowns are experiencing significant population losses. California lost approximately 239,000 residents last year, while New York and Illinois saw declines of 102,000 and 80,000 respectively.

You’ll find these demographic changes concentrated in major urban centers like Los Angeles, San Francisco, New York City, and Chicago.

The economic impact is becoming increasingly visible: labor shortages, shrinking tax bases, and reduced consumer spending are challenging local economies. High housing costs, heavy tax burdens, and limited job growth are driving this exodus, particularly among young adults and working-age residents. Many of these departing residents are relocating to southern states where affordability and job opportunities are more attractive.

These declining regions stand in sharp contrast to the migration magnet that Florida has become, attracting nearly 400,000 new residents annually.

Meanwhile, the proportion of seniors is rising in states like New Hampshire and West Virginia, accelerating the population decline as birth rates remain low.

Housing Market Reversal in Sun Belt Hotspots

You’ll find sharp price corrections accelerating across Sun Belt markets, with cities like Austin dropping 23% from peak values and West Palm Beach falling 4.9% year-over-year.

Investor activity has markedly declined as homes sit 15-20 days longer on market in former hotspots like Orlando, Miami, and Nashville. The housing heat index reveals a stark contrast between the cooling Sun Belt and strengthening Northeast markets.

The combination of oversupply (3.3 million new units since 2020) and slowing migration (from 44,000 to under 14,000 annually) has transformed these once-competitive markets into buyer-favorable environments with widespread price reductions. This shift reflects a clear regional bifurcation where Midwest and Northeast cities maintain seller advantage while Sun Belt listings languish.

Price Drops Accelerate

Once celebrated for their meteoric rise, Sun Belt housing markets have experienced a dramatic reversal, with price drops accelerating across formerly hot regions.

Austin’s values plummeted 23% from their 2022 peak, while Tampa declined 5.4% year-over-year—among the steepest drops in major metros.

Dallas, Phoenix, and San Antonio each saw 3.2-3.4% annual declines.

Three critical factors driving these price corrections:

- Monthly home price growth turned negative in half of tracked cities during peak buying season.

- 96 of 300 largest markets (32%) recorded year-over-year price declines (May 2024-2025).

- 50%+ of single-family homes in Denver, Charlotte, and Jacksonville listed with price cuts.

With inventory surging and migration slowing, buyer negotiation power has strengthened considerably.

This market shift is particularly evident with the Sun Belt’s massive inventory of 353,916 properties creating a buyer’s advantage across the region.

Price stabilization strategies from sellers now include significant reductions to attract limited demand.

The national home price growth slowed significantly to +0.5% year-over-year between May 2024 and May 2025, compared to +3.9% in the previous year.

Investors Flee Markets

While homeowners grapple with diminishing equity, institutional investors are abandoning Sun Belt markets at an alarming rate, exacerbating the region’s housing correction.

Large property buyers who aggressively expanded during boom periods are now liquidating holdings and walking away from developments, particularly in areas like Kern County.

This investor flight signals a profound shift in market confidence, as returns diminish and vacancy rates surge past 8%. Markets like Austin, Texas are experiencing a dramatic 5.1% projected decline, reversing years of rapid appreciation.

You’re witnessing the consequences of this exodus as investment liquidations flood markets with inventory, accelerating price corrections across the region.

The impact extends to rental markets, with prices softening by up to 6% in single reporting periods. This reversal contrasts sharply with historical data showing Sunbelt markets like Phoenix once experienced 8.9% annual growth in housing stock during the 1960s.

Investor sentiment has turned decidedly negative toward Sun Belt appreciation prospects, removing the institutional support that previously propped up these once-thriving markets.

The Perfect Storm: Oversupply Meets Weakening Demand

As pandemic migration patterns dramatically reversed course in 2023-2024, former boomtowns faced a devastating combination of surging inventory and evaporating demand.

This perfect storm emerged as net domestic migration to the South plummeted 38%, while inventory levels exploded across former growth markets.

You’re witnessing unprecedented demand fluctuations across regions that once couldn’t build homes fast enough:

Markets that once couldn’t build fast enough now face whiplashing demand, leaving developers scrambling to adapt.

- Denver’s active listings skyrocketed to 11,500+ units as inventory management became impossible.

- Phoenix inventory “absolutely exploded” with 8,600 new listings flooding the market.

- Over 33 of America’s 50 largest metros saw year-over-year price declines by July 2025.

The consequences are stark—Austin home values dropped 23% from their 2022 peak, while Phoenix median prices fell 15.1% year-over-year as higher mortgage rates crushed affordability and sent buyers fleeing overheated markets. Las Vegas exemplifies this nationwide trend with a 65.7% inventory increase year-over-year, the largest among all metropolitan areas. Atlanta’s housing market exemplifies this nationwide trend with active listings increasing to over 28,000, representing a staggering 92% rise from the previous year.

Regional Divides: Northeast Stability vs. Southern Decline

You’ll notice the Northeast has maintained surprising stability with 1.5% GDP growth in 2025, while former southern boomtowns experience sharp economic contractions.

This regional divergence stems partly from the Northeast’s resilient housing market where prices continue to rise, albeit moderately, compared to southern regions facing inventory gluts and price corrections.

Insurance costs further amplify this divide, with southern homeowners shouldering increasingly unaffordable premiums that severely restrict housing mobility and purchasing power.

East Gains, South Wanes

Despite conventional narratives, recent economic data reveals surprising stability in the Northeast compared to unexpected vulnerabilities emerging in the South. While Northeast labor markets demonstrate resilience with accelerating wage growth and unemployment projected at just 4.3% through 2025, the once-booming South faces mounting challenges.

Three key indicators of Northeast resilience:

- Personal income growth outpacing national averages despite inflation pressures

- Labor markets showing less slowdown than other regions with employment growth exceeding 1%

- Housing price stabilization at 4.2% growth rate for 2025

The Southern region’s former economic dominance appears threatened by these shifting patterns.

You’re witnessing a remarkable economic rebalancing as Northeastern states leverage their established infrastructure and educational advantages against Southern challenges that have emerged in post-pandemic recovery.

Insurance Cost Divide

While economic trends show surprising resilience in the Northeast, health insurance costs reveal a starkly different regional divide.

You’ll pay considerably more for coverage in Northeastern states—averaging $814 monthly for individuals compared to just $710 in Southern states, representing a $1,200 annual difference.

This insurance affordability crisis reflects regional economic disparities, with Northeast per capita healthcare spending exceeding the national average by 25%.

Urban-rural divides further complicate premium fluctuations; Philadelphia residents pay nearly double what Pittsburgh residents do for identical coverage.

Family coverage demonstrates even starker contrasts: Northeast families spend approximately $28,305 annually while Southern families pay $24,724—a $3,600 yearly difference.

These disparities reflect both regulatory environments and infrastructure costs, making geography a critical determinant in your healthcare expenses.

Changing Migration Patterns Across State Lines

As the United States experiences significant demographic shifts, migration patterns across state lines reveal clear winners and losers in the population exchange.

You’ll find the Southeast and Sunbelt dominating inbound moves, with South Carolina maintaining its top position for six consecutive years with a 1.97 in-to-out ratio. Migration drivers primarily include affordability, job opportunities, and access to nature.

State comparisons highlight dramatic population shifts:

- South Carolina gained 3.6% of its population through domestic migration between 2021-2025

- California lost 2.2% of its population during the same period

- Nearly 46% of Americans planning to relocate intend to move to Southern states in 2025

The migration tide is flowing from high-cost coastal regions toward more affordable “purple” states, reshaping America’s demographic landscape.

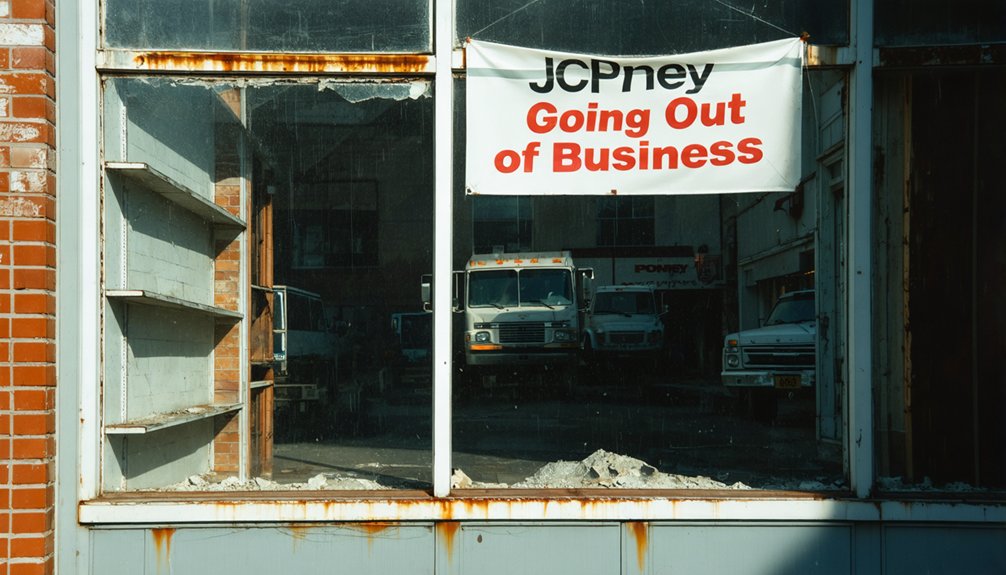

Economic Pressures Reshaping Urban Landscapes

The economic transformation of America’s former boomtowns reveals a stark reality in numbers and trends. Manufacturing jobs plummeted by 3.5 million between 2000-2009, replaced by lower-wage service positions that widened economic inequalities.

America’s industrial heartland hemorrhaged millions of jobs, leaving only lower-paying service work that deepened economic divides.

When GM closed in Hamtramck or steel mills shuttered in Johnstown, entire economic ecosystems collapsed.

You’ll find the most devastating urban decay in communities that over-specialized—like oil counties where per capita incomes settled 6% below pre-boom levels after the bust cycle completed. Tax bases eroded as populations fled, leaving infrastructure crumbling.

Small towns far from metropolitan centers suffered worst, with persistent unemployment rates higher than before their boom periods.

The data shows a troubling pattern: resource depletion, globalization, and technological change have systematically hollowed out once-thriving industrial centers, leaving limited pathways for economic renewal.

The New Reality for Former Growth Havens

Former pandemic-era boomtowns now face unprecedented market corrections that signal a dramatic reversal of fortune across the American landscape.

You’re witnessing Florida’s net domestic migration collapse from +314,000 to just +64,000 in two years, while Texas plummeted from +222,000 to +85,000, revealing the vulnerability of these once-unstoppable markets.

- Tampa, Phoenix, and Miami have officially entered price decline territory, undercutting the pandemic appreciation that fueled their growth.

- 85.7% of Idahoans can’t afford new homes in Boise, rendering urban revitalization strategies ineffective without addressing affordability.

- Former coastal hotspots are being replaced by inland alternatives like Raleigh and Myrtle Beach, creating opportunities for economic diversification efforts.

This migration reshuffling reflects Americans’ pursuit of value as oversaturated Sun Belt markets surrender their dominance to secondary cities offering better cost-value equations.

Frequently Asked Questions

When Will Housing Prices in Former Boomtowns Bottom Out?

You’ll see housing market bottoms extending into 2026, as most corrections have lasted 2-3 years since 2022 peaks. Price stabilization depends on local income alignment and supply normalization.

How Are Local Businesses Affected by Population Decline?

You’ll witness 22.3% fewer new businesses forming as population drops, with existing ones facing revenue losses, business closures, and reduced community support. Labor shortages emerge despite shrinking customer bases.

Which Cities Are Benefiting From These Migration Reversals?

While migration patterns aren’t strictly reversals, you’ll find Midwestern cities like Buffalo and Cincinnati experiencing population influx alongside Rust Belt revivals in Pittsburgh and Detroit, with urban revitalization transforming these once-declining regions into opportunity hubs.

What Happens to Municipal Budgets When Population Declines?

Your municipal budget shrinks dramatically as tax revenue falls by over 20% per capita. You’ll face budget cuts across services while maintenance costs for aging infrastructure rise by 47%, creating a fiscal trap.

Will Remote Work Trends Stabilize or Continue Reversing?

The remote work pendulum has found its rhythm. You’ll see stabilization in 2026, with the current 22% remote workforce likely holding steady while economic impact assessments drive company flexibility decisions.

References

- https://www.youtube.com/watch?v=wP80-MX7lOg

- https://www.youtube.com/watch?v=EGCmCZbxdOk

- https://sunrisecapitalgroup.com/us-housing-market-trends-in-2025-the-top-10-cities-where-prices-are-dropping/

- https://newfed.com/september-2025-housing-market-update/

- https://www.scotsmanguide.com/news/more-us-metros-recording-annual-home-price-declines/

- https://www.resiclubanalytics.com/p/net-domestic-migration-which-states-are-gaining-and-losing-americans

- https://www.census.gov/newsroom/press-releases/2025/vintage-2024-popest.html

- https://investorsobserver.com/news/americas-pandemic-housing-boom-turns-to-bust-in-these-9-cities/

- https://www.rprealtyplus.com/index.php/international/usas-boomtowns-experience-steep-home-price-decline-117140.html

- https://presencenews.org/us-population-2025-growth-decline-trends/